[ad_1]

In accordance to Michigan Retailer Association’s analyze of retail gross sales presented in its 2021 Invest in Nearby Analyze, countrywide ecommerce income grew from 8.8 % of whole retail income in 2017 to 10.7 % in 2019, and then jumped yet again to 13.6 % in 2020. Though this info is tricky to delineate at a condition-degree, there’s no doubt that Michigan’s retail sector has likely gone through a very similar transformation.

Amid the COVID-19 pandemic, adding ecommerce as a method for advertising has been critical for quite a few Michigan suppliers. With no it, a lot more suppliers would not have survived the pandemic.

As on the internet profits increase, so does fraud

As much as stores have benefited from ecommerce product sales, on-line credit rating card fraud has jumped drastically throughout the U.S. According to LexisNexis, U.S. ecommerce retailers reported a 140 % improve in fraud attacks due to the fact 2020. Also, in accordance to a recent posting in Organization Insider, card-not-current (CNP) fraud is predicted to expand by 14 percent in the future four years.

A single of the most common means cyber criminals get stolen credit card figures is through the darkish net. Most stop by a web-site on the dark world wide web and invest in stolen credit rating cards in bulk with the objective of screening them to locate the types that get the job done. In 2019, there had been at least 23 million stolen credit rating card figures for sale on the dark net. That selection has only improved given that then.

What does this fraud mean to your business? Believe far more chargebacks, penalties, misplaced income, and a new standing among criminals that your organization is an straightforward concentrate on.

I say this often: fraud prevention is a journey, not a vacation spot. Cyber criminals are really innovative and they alter procedures frequently and frequently. There are, nonetheless, 3 steps you can take that will enable you reduce fraud for the duration of a transaction. They can expose a possible credit history card theft in the earning.

- Do you take observe if your terminal encounters an EMV chip malfunction?

When most of this post is linked to ecommerce, one of the strategies that terrible guys use stolen card quantities is by means of a encounter-to-face transaction that is not “dipped” into the chip reader.

Though most merchants use an EMV chip reader, terminals are established up to allow for transactions to be processed applying a magnetic strip to accommodate older playing cards with out chips, or cards with malfunctioning chips. This is the loophole that criminals are now exploiting.

If a negative guy has a excellent card amount (and the connected data from the mag stripe), they can encode that on a authentic card and then injury the card’s EMV chip. This will drive your terminal to settle for a swipe (with the stolen card number on the magazine stripe, as a substitute of the respectable card number).

When they make a invest in, they insert the card in the chip reader, which will report an error for the reason that the chip are not able to be read through. Then, they will inform the clerk that they’re acquiring troubles with the EMV chip on their card and request if they can total the transaction by either swiping the magnetic strip or having the clerk crucial in the account range, bypassing the EMV chip reader all with each other.

Choose notice, you require to be vigilant with your team about constantly applying an EMV chip reader. The key card networks have clear principles about this. If a merchant enables a client with an EMV chip credit score card to make a buy by swiping the card in lieu of working with the chip reader, any chargebacks filed against the transaction will routinely be found in the cardholder’s favor.

Inform your employees to acquire notice when this comes about, specially if it is a substantial-ticket variety such as jewelry, appliances, or a laptop. If your EMV chip reader proceeds to fall short, it may possibly be time to update your technique.

- Does your web-site need a three-digit stability code for all on the web transactions?

According to a 2021 Nilson Report on credit score card fraud, the amount of income lost to card-not-present fraud in 2020 was six moments increased than what merchants shed just just one year earlier. For this reason the want to make confident that any buys produced on your internet site have to have a safety code.

A credit score card security code, normally known as the card verification value 2(or CVV2) is the 3 or 4 -digit code usually discovered on the again of a credit score card. The CVV2 delivers an added layer of security by verifying that the purchaser is in possession of the card.

To keep PCI compliant, you are not permitted to store CVV2 codes on your procedure. This will help in safeguarding clients from a information breach and makes it challenging for cyber criminals to get a customer’s CVV2. Not complying with global PCI Information Safety Benchmarks could final result in hefty fines or even even worse – the cancellation of your merchant processing accessibility by the payment processor.

- Does your website consist of a CAPTCHA as portion of the checkout process?

Just one of the issues that negative fellas have is figuring out if the card figures that they purchased on the dark world-wide-web are nonetheless energetic and “good.”

A typical on the net technique used by criminals is obtain internet sites to take a look at a team of stolen cards by conducting minimal-amount of money transactions, generally $1 or $2 to come across the cards that are however active. This sort of account screening is recognised as “card tumbling.” One of the big consequences of getting a sufferer of a card tumbling assault like this is the sizeable fees your account can come about if the scale of the assault is sizeable. Some illustrations of expenses include authorization, clearing and settlement, interchange, and gateway transactions.

Anything you can do to gradual down the process of acquiring an authorization endeavor on a transaction retains card tumblers at bay. This is where by which include a CAPTCHA as section of your on-line checkout system plays a important role. According to Dictionary.com, the origin of CAPTCHA stands for “completely automated general public Turing examination to explain to computer systems and humans aside.” It is a form of problem-reaction examination utilized to determine no matter if the person is a human or a bot. To pass the check, end users need to interpret distorted text by typing in appropriate letters into a variety discipline. In the situation of a re-CAPTCHA, the user is required to recognize a set of objects in a image.

While CAPTCHAs receive their honest share of critics, they’ve completed a remarkable career in safeguarding ecommerce web sites from brute force assaults.

As outlined at the commencing of this report, this method of protecting on your own is a journey, not a destination. It is anything that you must be having to pay awareness to regularly.

As usually, if you have queries about this issue or any other merchant processing concern, be sure to never wait to call our purchaser support staff at 800.563.5981

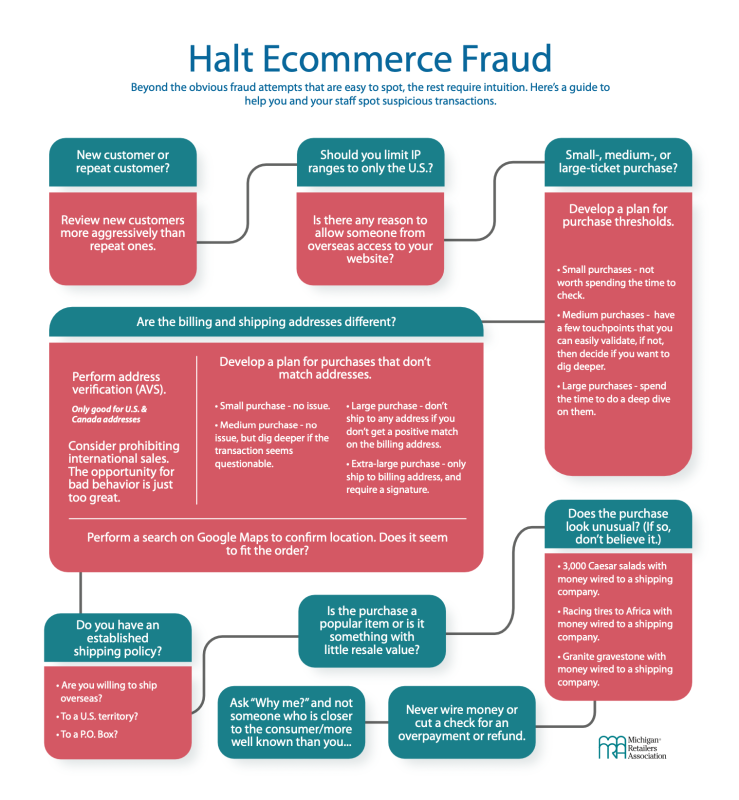

Use this Ecommerce Fraud Selection Tree graphic to aid you and your employees place suspicious transactions.

[ad_2]

Resource connection

More Stories

Fashion Designer Trends Shaping the Industry

Exclusive Interview with a Revolutionary Fashion Designer

Becoming a Fashion Designer: What It Takes